Thirteen ways to get extra cash in a hurry

We’ve all been there. There are times when an unexpected bill drops on the doormat, or when something important (such as your fridge or cooker) breaks down. Even if you are good at budgeting and know your income and outgoings, there can still be times when you need extra cash quickly. In this article, we look at thirteen ways to get extra cash in a hurry. Hopefully these ideas will help you out when you need money, fast!

1. Chase any money you are owed

If you need money in a hurry, then now is the time to chase any money that you are owed. This could be from friends and family members, from your workplace or within your business. We once paid for a flight on our credit card for a good friend. We never forgot about it as it was over £500. But our friend moved back home to the USA, fell on hard times and didn’t pay us back. Eventually, we got around to chasing him for it and he paid us back. It was awkward at times but we kept reminding him, and we got there in the end.

Having a conversation with your friends and family about the money they owe you can be awkward. But if you have a large bill to pay then it’s no time time to be shy about asking them to pay you back. You can use that large bill or expense to start the conversation – e.g. ‘My cooker has broken down and could really do with that money back so that I can pay to repair or replace it. My bank details are…’

It is also worth thinking about whether your workplace owes you any money – for example, have you submitted all of your expenses recently?

If you run your own business or have side hustles, then make sure your clients have paid their invoices, and withdraw any earnings in places like survey websites and cashback websites. If you do matched betting, check that you haven’t forgotten to withdraw from online bookmakers.

2.Withdraw savings

Most people who need cash in a hurry will not have access to savings. But if you do – and you can withdraw your savings without (much of) a financial penalty – then you should definitely consider doing this. You can always make replenishing your savings a priority once you are back on your feet.

3.Sell your unwanted items

Selling your unwanted items, especially somewhere like Facebook Marketplace or Gumtree (where a buyer can collect quickly) is a great way to get some extra cash in a hurry. You don’t always have to sell big-ticket items to make decent money; it is amazing how smaller sales add up. If your unwanted items are more bric-a-brac, you might consider having a garage sale or selling them at a car boot sale. Just be ready for an early start and for people to haggle on the price!

If you don’t need the money immediately, you could also list your unwanted items for sale on eBay and other online platforms such as Vinted and Depop.

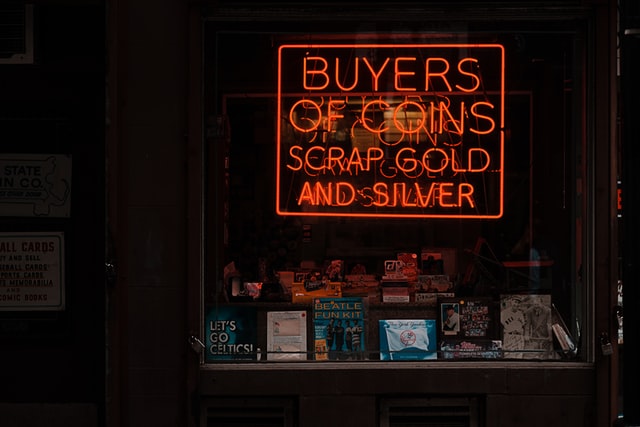

4. Sell old gold

If you have any old unwanted gold, you can sell it for a quick profit. This could be jewellery that you no longer use, unwanted gifts, broken pieces, and even gold tooth fillings! Be careful about who you send it to and check a company’s feedback carefully first. We’d also recommend that you post it using an insured, trackable service so that you can lodge a claim if your gold goes missing.

5. Use a pawnbroker

If you have some high value items or valuable collectors’ items that you are not ready to part with, consider pawning them. Be aware that the pawnbroker will charge you interest on the amount that you have borrowed, and may sell your item if you don’t repay the money that you have borrowed.

6. Cash in coins

If you have been saving your UK coins and spare change in a jar or piggy bank, now is the time to cash them in. Don’t use a coin machine in a supermarket as they charge you a percentage of the total value of your coins. Instead, take them to a bank or Post Office to cash them in for free and avoid paying fees (you may need to sort and bag them first). Some HSBC banks also have coin deposit machines which are free to use if you have an account. Search for HSBC branches, and tick the ‘coin deposit’ box (under ‘more search options’) to find the branches that have these machines.

7. Cash in foreign currency

If you have any leftover foreign currency from a holiday, you can cash this in too. Many banks and foreign exchanges will only take higher value bank notes, however there are some places that will take both notes and coins. You can even exchange foreign coins from multiple currencies at the same time. Bear in mind that the exchange rate for coins is not as good as the rate for notes, as coins are more costly to process. Cashing in your foreign currency is especially useful if you have notes and coins from places that you are unlikely to visit again. Our tip: sometimes these machines don’t recognise all notes and coins on the first try, so try any rejected notes and coins a few times to see if they are accepted.

Alternatively, if you have foreign currency for a destination where a friend or relative is going on holiday, why not sell it to them directly? – This will be easier to do with popular destinations and currencies than more obscure ones.

8. Ask friends and family for a loan

Well done! You’re now over halfway through our thirteen ways to get extra cash in a hurry!

If you’re fortunate to be in a position to borrow money from friends or family, now might be the time to ask for that loan. Swallow your pride and consider whether you’d be willing to help a friend in a similar situation. This will make it easier to ask for help. If you get cash in a hurry in this way, it is only fair to arrange a repayment plan. Make sure that it is realistic for you, and that you can stick to it. Keep the lender up to date with any changes to your circumstances that might impact your repayments.

9. Rent out a room

If you have a spare room, consider listing it on Airbnb or renting it out to a tenant. Airbnb works well as the visitor would only be there for a short time. You can list and deactivate your listing as you wish, as well as carefully vet any potential visitors. Renting to a reliable tenant will give you are more consistent, long term income. Renting out a furnished room is a great tax break too, as you can earn up to £7500 per year tax free in this way. Note that this tax free amount is shared with other occupants if you don’t live alone.

10. Rent out your parking area

If you have a driveway or parking space that isn’t used for long periods, consider renting it out. If you live somewhere where parking is difficult or in high demand, this will be easier to do. For example, you may live near a train station, sports stadium, city centre or other attraction. As with renting out a room, check the terms of any tenancy agreement or leaseholder agreement that you may have so as not to fall foul of the rules.

11. Offer your services when you need cash in a hurry

Whether it is cutting someone’s grass or offering them help with their social media, let people know that you have services to offer and see how much money you can raise. Some ideas for the services that you can offer include:

- Cutting grass

- Weeding

- Other gardening jobs

- Window cleaning

- House cleaning

- Washing cars

- Hair and beauty services

- Babysitting

- Dog sitting

- Cat sitting

- Dog walking

- House sitting

- Collecting groceries

- Running errands

- Bookkeeping

- General admin tasks

- Social media management

- Website building

- Writing articles

Even if you’re not interested in taking on long-term clients, doing jobs for others can really help you out quickly when you need cash in a hurry.

12. Use a credit card

Although it would be great to avoid having to take on debt, sometimes using a credit card can give you a little bit of breathing room. Credit cards can offer you up to 56 days of no interest for your purchases, depending on when your transaction takes place and when your bill is due. If you pay off your credit card in full when the payment is due then you won’t pay any interest.

Sometimes this breathing room is all you need to help you out. If you have a large purchase to make, consider a new card that is 0% (interest free) on purchases for a certain period, such as 12 or 18 months. You should then be able to budget to clear the amount you need to spend before the interest free period expires, You will need to be disciplined and not spend more on this card than you can afford to pay back. If you over spend, or don’t keep up your repayments, you may be hit with large interest charges.

13. Take out a loan

Taking out a loan when you need emergency money should be a last resort as it could mean that you are making payments for years to come. If you do need to consider taking out a loan then look for the best deal for your circumstances. Take into account the interest rate as well as the length of the loan. Avoid high-cost, short term loans, unless you have no other option. These are costly, the debt can increase quickly, and this can cause additional stress, worry and problems further down the line.

We hope these thirteen ways to get extra cash in a hurry will help you out of a tight spot. Do you have any other (legal!) ways of getting money in a hurry? Let us know in the comments below.

Win a £50 Amazon gift card - Fun, Free and Frugal

[…] getting more expensive by the day! If you need to raise some funds there are ways in which you can raise cash in a hurry. Here at Fun, Free and Frugal, we’d also like to lighten the load a little, and you probably […]